The Rise of Financial Super Apps: How Fintechs are Converging

Fintechs apps are slowly becoming clones of one another

Back in May of 2020 I argued that Meta (then Facebook) would transform Whatsapp into a super app.

My hypothesis revolved around Meta leveraging Jio, an Indian telecommunications company they invested $5.7B into, to propel Whatsapp into a multifaceted entity encompassing payments, communication and content — a western WeChat competitor, if you will1.

Spoiler: I was wrong.

Super apps à la WeChat never took off in Europe or the U.S, or anywhere else outside of Asia for that matter.

A lot of very thoughtful people have written about why super apps don’t work in the U.S., why they don’t work in the West, why they won’t work at all, or even why Elon Musk’s attempt at a super app will never work.

While there are no super apps outside of Asia, there are actually plenty of financial super apps. For a while now, consumer finance apps have been developing new capabilities and have slowly evolved to offer to become the financial super (or the “go to” money app), and in doing so, have all morphed into the same app.

The Financial Super App

Have you ever noticed that your financial apps now almost all offer a card, a way to invest (stocks or crypto, or both), a budgeting tool/spending reports, FX, a way to pay friends, etc.?

Although there are myriad of different financial apps available, over the last ~5 years, the features of the consumer Fintech apps in Europe and the US have increasingly converged. In short, they’ve all merged to become financial super apps.

Let me explain.

Feature Convergence in Consumer Fintech Apps

When I was in college, Venmo was becoming popular. At the time, it was nothing more than a digital wallet used to send money to friends. It solved a core problem (quickly sending money to friends) and distinguished itself through its ease-of-use and social network aspect.

At the same time, in France, Lydia was quickly rising as a popular app for payments between friends.

Today, both of these companies offer physical cards, both offer virtual cards, both have some sort of short-term credit offer, both have business accounts with associated features, etc. You’d be hard pressed to find core differences between these two apps (Lydia’s logo even looks like an upside-down Venmo logo… or perhaps it’s the other way around?).

However, this trend doesn’t just apply to peer-to-peer payment apps. Regardless of whether the app started as an investing platform like Robinhood, a payments platform such as Venmo/Lydia, a FX app like Wise, or even a traditional bank like Société Générale (SG) or Bank of America, consumer apps today share a very similar set of features, if not the same (see below).

Why Consumer Fintech Apps are Converging

I noticed this phenomenon with my own app stack and started wondering why this was happening.

Now, I hear you coming from a mile away: “these apps are just copying each other” or “Ben, this is just an example of users demanding the same set of features”.

Yes… and no.

I believe that the observable convergence of features within consumer fintech apps comes from 2 sources: a shared user base who is demanding a similar set of features, and a profit-driven top management.

Shared User Base

While I am sure that the Venn diagram of shared users across mobile banking apps, FX apps, P2P payment apps, and others is quite significant, I don’t believe that it is the shared user base that is the primary reason Fintechs are developping the same set of features.

Profitability

Instead, I believe that Fintechs realized the best way to make money is to keep their users’ money in the app and sell more services. For example, prior to launching a card Venmo users would receive money from their friends and immediately send the money to their primary bank account. By offering a card, Venmo users can now spend the money they receive from their friends directly within Venmo.

Doing so means Venmo can earn money from interchange fees. In addition to this, by keeping the money within the app, it also means that users are more likely to try some of the additional services available within the app (investing, payments), generating additional revenue.

At the same time, keeping money within the app also saves on bank transfer fees. Indeed, taking money out of the app and sending into a user’s bank account can often be quite costly.

At my previous employer, users would send money from their wallet to their bank account on a near-monthly basis. Even with a small user base (~30K), it was costing us a lot of money to support. By keeping money in the app and finding ways to push to leverage that sitting cash, we could save on transfer costs and potentially generate additional revenue from new services.

All in all, I believe that it’s because of Fintechs realizing that by keeping money within the app they could generate additional revenues and lower costs that we are fintechs converge to a similar set of features that make up, in essence, the same shared notion of a “financial super app”.

Behind the Scenes of Feature Convergence

Although it is easy to point out that consumer Fintech apps have been converging towards the same shared notion of a “financial super app”, building all the necessary features to get there is a lot harder — especially when you consider how each app has different value propositions and core competencies2.

However, I believe that the aforementioned feature convergence has been vastly accelerated thanks to embedded finance and BaaS (Banking as a Service) providers3.

Embedded finance and BaaS providers can enable new user experiences that are removed from a company’s core competencies. In short, the providers enable Fintechs to outsource the expertise and regulatory compliance, enabling them to launch features much faster (and thus keep up with their peers, who are doing the same).

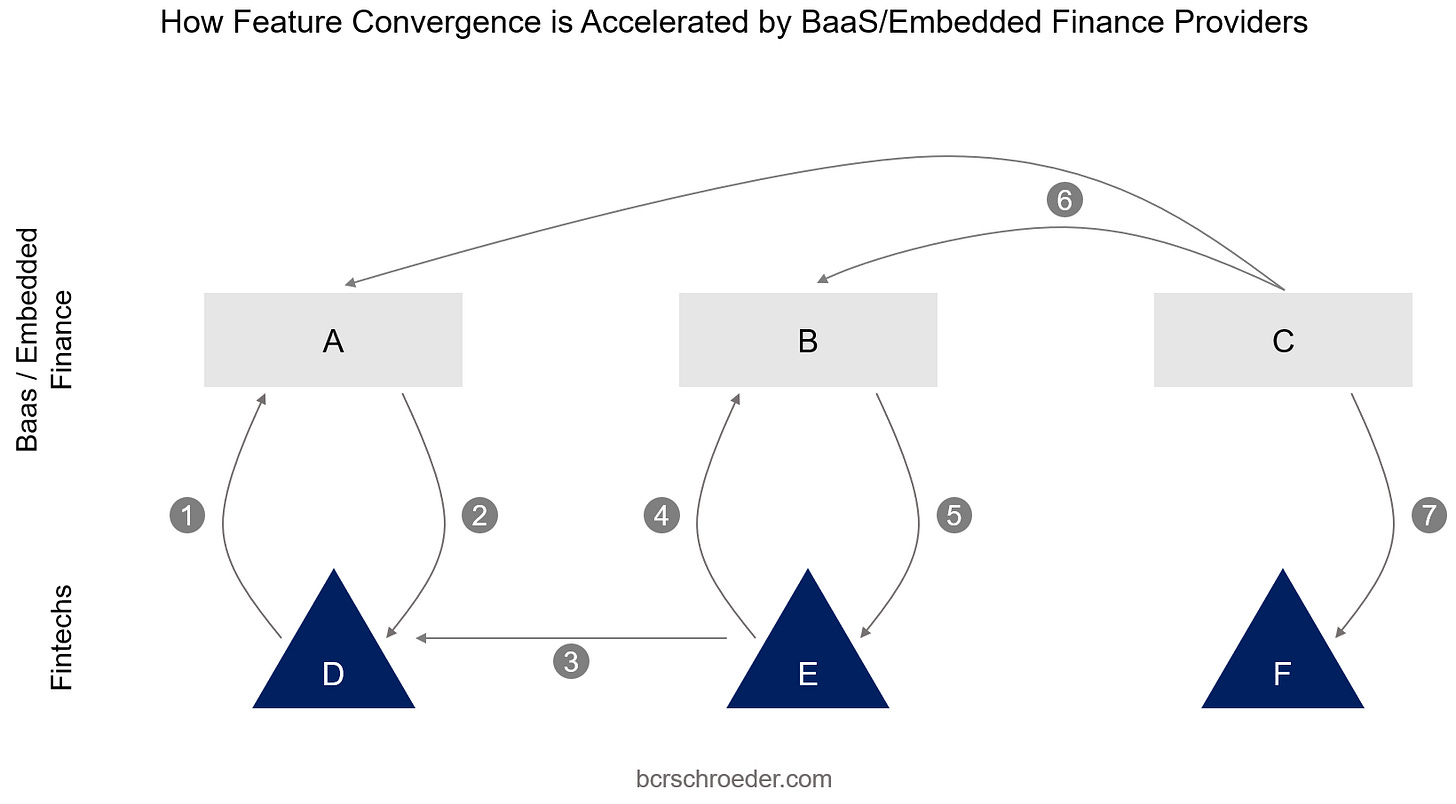

As a result, I suspect that the competition between BaaS and Embedded Finance providers is accelerating the convergence of features as the providers compete with one another to offer similar use cases (see below).

Fintech D wants to launch a new feature, they go to provider A for it (ex: .

Provider A builds the use case with Fintech D and D launches it.

Fintech E sees Fintech D winning market share thanks to this new use case.

Not wanting to lose market share, Fintech D goes to provider B asking for the same use case.

Provider B builds the use case with Fintech E, they launch.

Provider C sees the success of the new use case and builds it.

Having built a new feature, provider C pushes it to their existing client base, Fintech F.

The result ? Fintech F accepts and now, all the Fintechs have a set of features.

Naturally, I am tremendously simplifying the market dynamics and the convergence of features cannot solely be attributed to this effect. Similarly, I’ve taken the liberty of grouping together BaaS and embedded finance providers under the underlying principle that both unlock new use cases to their clients.

What’s Next

When each app had its purpose, it was normal to have multiple apps on your phone: you had one app for banking, one for FX, one for budgeting, one for P2P payments, etc…

However, as features become increasingly consolidated, Fintechs are fighting to become the financial super app, or the “go-to” money app. International digital banks seem to have a slight advantage as it’s become increasingly accepted by consumers to use a digital bank as their primary bank. Additionally, these digital banks are starting to detach themselves from the pack as they post very healthy profits and sustained growth, with more yet to come.

This begs the question: what about the others ? Is there enough market share for all of them to claw their way through and become a financial super app ?

Personally, I don’t think that they will be able to become the “go-to money app”, some will inevitably lose market share and resort to specialization as a means of differentiation. Become the very best app in FX, so good that the benefits outweigh the switching costs, and they will be able to remain. Perhaps there is an opportunity to sell that best-in-class, specialized UX to other apps who are looking to become financial super apps.

Only time will tell.

If you enjoy my work, I’d appreciate it if you could subscribe to the newsletter.

One could argue that Meta is essentially one massive super app given their ability to leverage user data from one platform to another in the U.S. (shoutout to the E.U. for implementing data protection measures to keep its citizens protected from this). In my eyes, this logic shows the dire need for Meta to be broken up but that is a whole other talk show.

The main job (and core competency) of a bank is to lend money, not to crypto investing or consumer budgeting. Yet, this is being required of them. As a result, it’s often more difficult for these companies to launch annex features because they are far removed from their core competency and their legacy infrastructure. Same goes to all the other apps for that matter: Robinhood’s core competency is to acquire and sell order flow, Venmo is to transit money between friends, etc.

Fintech experts will point out that BaaS and Embedded finance are two very different things. For the purpose of this exercise I am categorizing them into one big category, which is that they both enable new user experiences and new features for companies who’s core competency is not banking (BaaS), or not payments (Embedded finance), or not lending (embedded finance), etc.

Enjoyable read Ben - thanks for sharing. I was surprised to see Revolut Pay’ as an option within the AerLingus app… wondering how long it will be until that’s commonplace.

Directionally, the super app feels like it’s only a few steps away, if not already here. I can’t envisage something like WeChat, given its unique positioning, but a super app doesn’t feel far away.

Scheme changes and future legislation will allow the banks to catch up quite quickly - but will it be too late by then? We shall wait and see.